Import Customs - Customs Procedure 40

النقل والخدمات اللوجستية

الشحن والخدمات اللوجستية

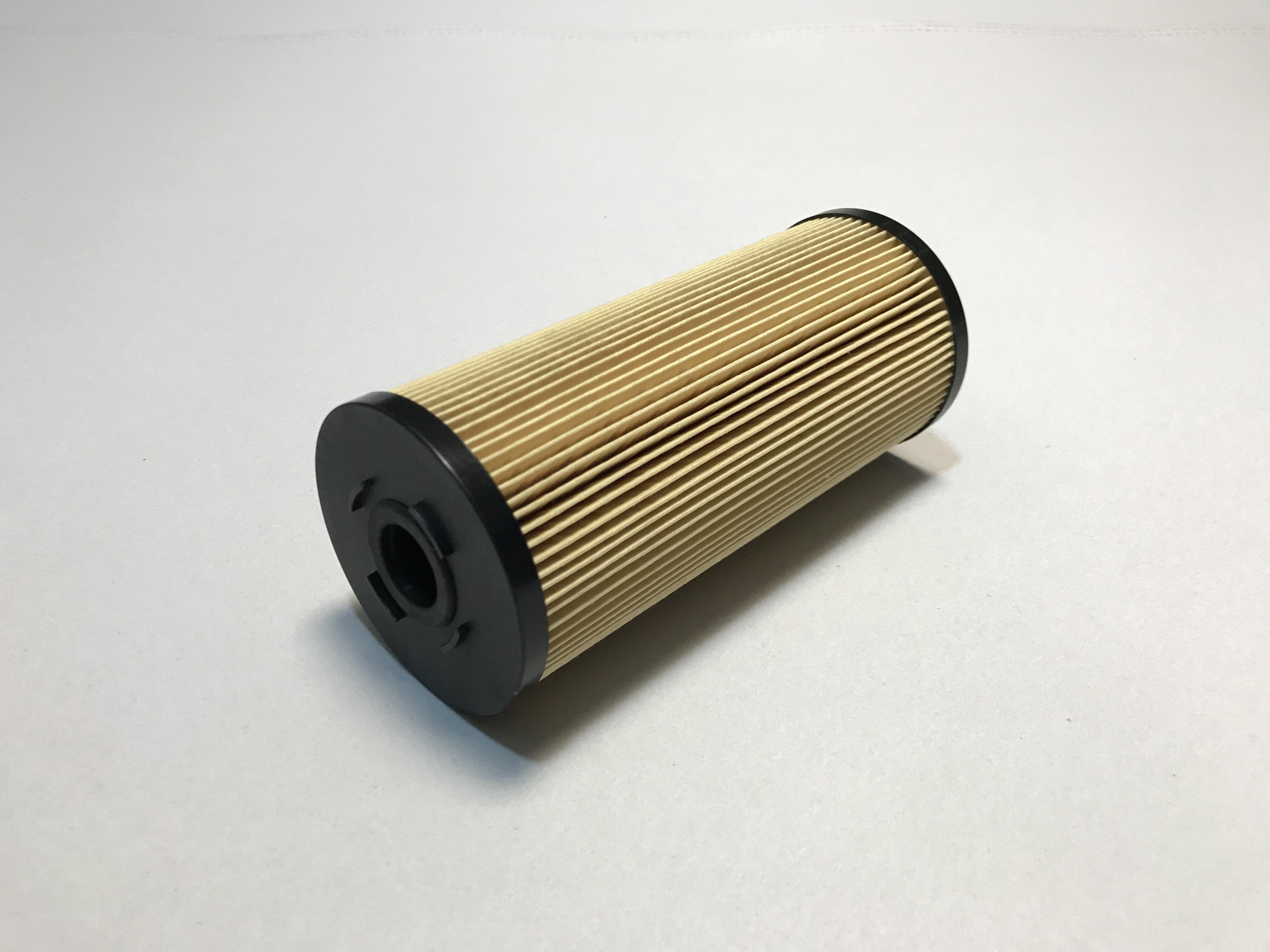

وصف المنتج

Import Customs - Customs Procedure 40;

Import Customs Clearance under procedure 40 means the release of goods into free circulation following the payment of customs duty, VAT and other taxes (anti-dumping taxes, agricultural taxes, excise duties and vehicle taxes). If the package undergoes import customs clearance in the territory of the destination country, all duties must be paid prior to the release of these goods into free circulation for the importer to be able to dispose of them freely. If the packages hold a preferential origin, they may be cleared under a reduced rate or zero rate. This means that customs duties do not have to be paid, only the VAT is billed on import. Preferential origin may be proved in several ways: with the EUR.1 form, with the statement of the exporter on the invoice, and with the statement of the authorised exporter on the invoice. The advantages of Customs Procedure 40 after the customs procedure, the importer can dispose of the goods freely;

مناطق التجارة

Copyright Netetrade 2025. Developed by Yartu Labs