Import Customs - Customs Procedure 42

Transport et logistique

Expédition et logistique

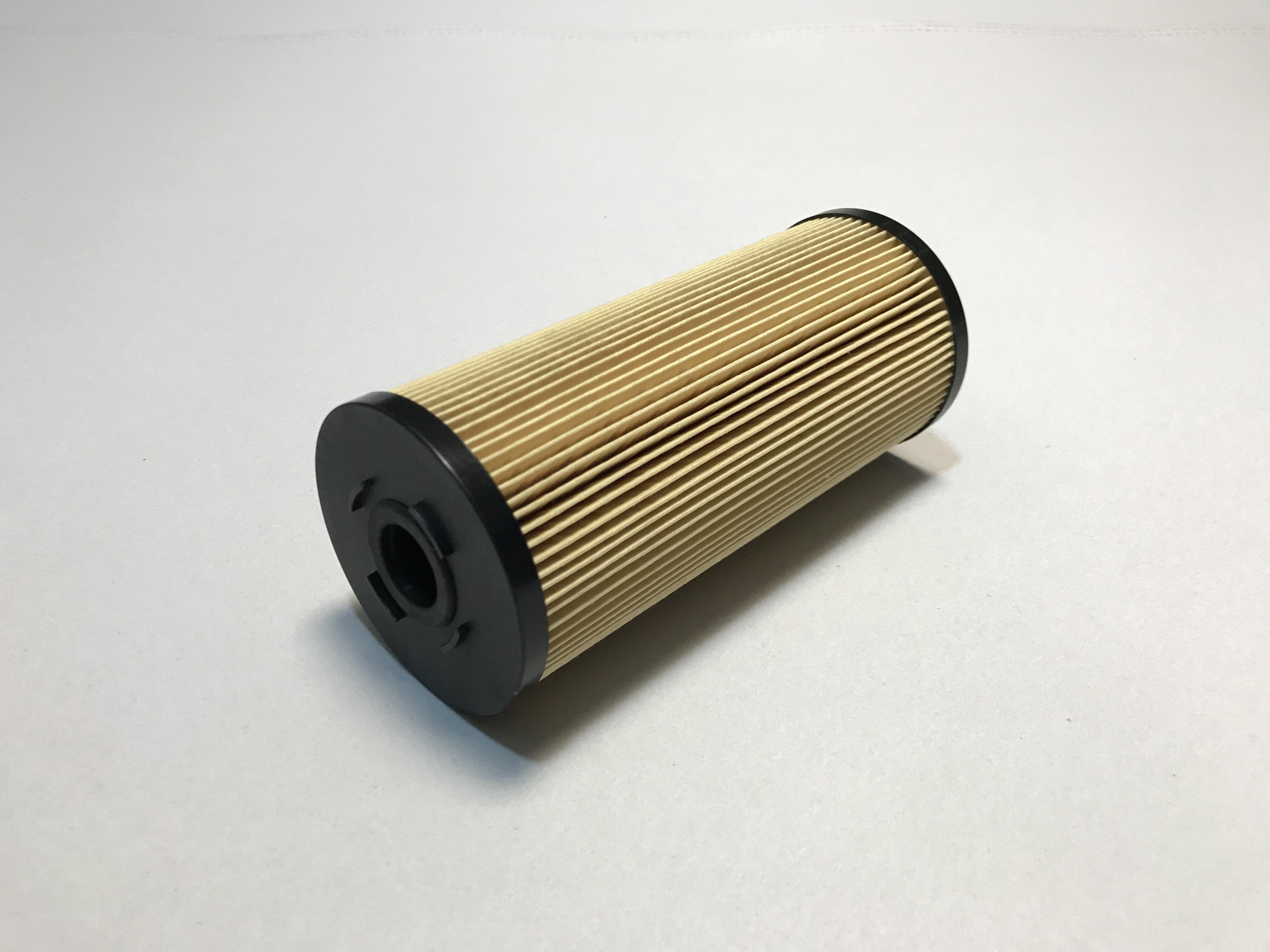

Description du produit

Import Customs - Customs Procedure 42;

Imported goods released into free circulation in a member state incur a VAT tax of that member state. If, upon import, it is known that the imported goods were meant to be shipped to another member state, the VAT is paid/charged in the destination member state. The VAT exemption on import is based on the fact that the import is followed by a tax-free delivery within the European community or the transfer of goods to another member state. Procedure 42 is allowed if the declaration contains: the Slovenian VAT ID of the receiver from field 8 EUL (under the code Y040) or their tax representative; the VAT ID of the receiver of goods from another member state; The Advantages of Customs Procedure 42 exemption from VAT payment; when entering the EU, only customs duties are payable. impact on the monetary flow of the importer: the importer needs liquid assets to cover any customs duties, but not to cover VAT. can carry out a customs procedure on the basis of simplifications (HU).

Zones commerciales

Copyright Netetrade 2025. Developed by Yartu Labs